We understand that everyone’s financial situation is unique. That’s why many of our supporters choose to give stock, a grant from Donor Advised funds, or make a Qualified Charitable Distribution. These methods are often more “tax-smart” than giving cash.

Particularly if you’re over the age of 70 ½ , you may want to consider donating directly from your IRA. This is known as a Qualified Charitable Distribution, or IRA Charitable Rollover, and it can be a tax-efficient way to support The WARM Place. Here are a few important details:

- A Qualified Charitable Distribution (QCD) enables individuals age 70 ½ or older to give directly from your IRA without the distribution counting as taxable income

-

If you have a required minimum distribution from your IRA, making a QCD to The WARM Place counts toward your required minimum distribution without counting as taxable income

-

You can make a qualified charitable distribution by informing your IRA custodian that you want to donate to The WARM Place directly from your IRA

You can give any amount (up to a maximum of $100,000) per year from your IRA directly to a qualified charity such as The WARM Place without having to pay income taxes on the money. Gifts of any value of $100,000 or less are eligible for this benefit and you can feel good knowing that you are making a difference for children and families receiving grief support at The WARM Place.

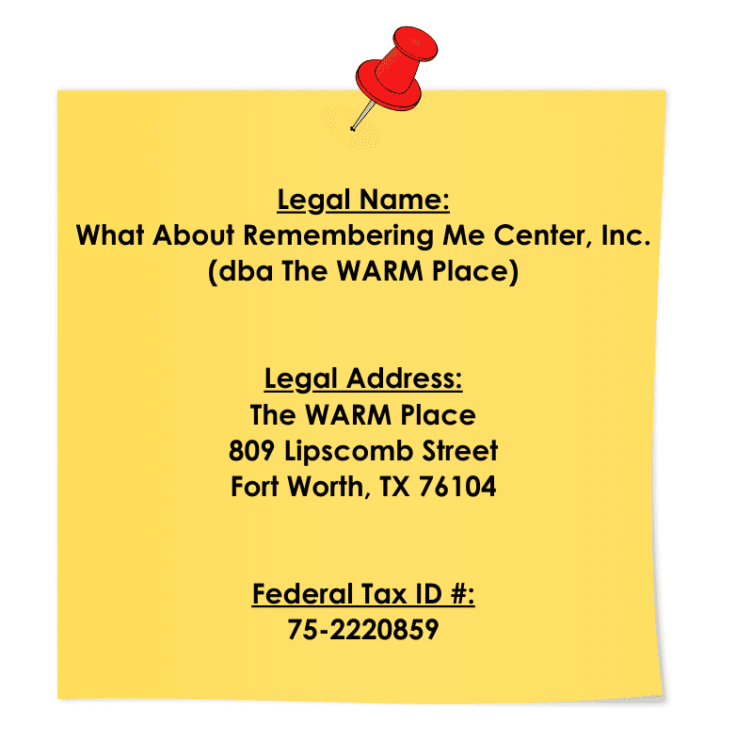

To include The WARM Place in your plans, please use our legal name and federal tax ID (see below). Also, please let us know of your gift, as many retirement providers assume no responsibility for letting nonprofits know of your intentions. Lastly, we encourage you to seek the advice of your financial or legal advisor.

We are continually inspired by the generosity and dedication of our supporters, and we are incredibly grateful for your trust and support. Remember, when you donate to The WARM Place, you’re not just making a gift—you’re joining a community of supporters who are committed to helping grieving children.

*For a gift from your IRA to be eligible for your current year tax return, it must be completed by December 31. Remember that it may take several business days to process after you submit the information. For questions or more information, contact Katie Lane, Director of Development at 817-870-2272 or katie@thewarmplace.org.